For Your Safety

Online Safety

The security of your personal information is of the utmost importance to Amistad Bank. As such, we would like to offer these tips to help protect your data.

Please consider the following when using our website, associated online banking, and general internet locations:

- We will not send any electronic communications (e-mail or text messages) requesting your account information, account verification, passwords, codes, or similar information. If you have reason to doubt the validity of such communications please contact us.

- Be cautious when clicking any links or attachments in e-mail messages could expose your computer to malicious programs.

- You should not send sensitive or personal information via e-mail to the bank without a method of encryption. Instead, look for alternate methods of transmission.

- Ensure your internet connection is sufficiently protected using any and all methods available including, but not limited to, routers, firewalls, antivirus software, and antispyware software.

- Ensure your operating system and all supporting software is updated regularly.

- Ensure your passwords used to secure sensitive information are at least 8 characters that include a combination of uppercase letters, lowercase letters, numbers, and special characters.

- Passwords should not be used for multiple websites.

- Change your password regularly or when you have reason to believe it has been compromised.

- Do not share your password with others.

- When using online banking verify the website address indicates a secure connection (https://...).

- Be cautious when using public internet kiosks to conduct any private business.

ATM Safety Disclosure

ATM SAFETY PRECAUTIONS

As issuers of Automated Teller Machine (ATM) access devices, we have provided for your information a list of safety precautions regarding the use of automated teller machines. Please read the following safety precautions:

- remain aware of surroundings and exercise caution when withdrawing funds;

- inspect an unmanned teller machine before use for possible tampering, or for the presence of an unauthorized attachment that could capture information from the access device or the customer's personal identification number;

- refrain from displaying cash and put it away as soon as the transaction is completed; and wait to count cash until the customer is in the safety of a locked enclosure, such as a car or home;

- protection of the customer's code or personal identification number, such as a recommendation that the customer ensure no one can observe entry of the customer's code or personal identification number;

- safeguarding and protection of the customer's access device, such as a recommendation that the customer treat the access device as if it were cash, and if the access device has an embedded chip, that the customer keep the access device in a safety envelope to avoid undetected and unauthorized scanning;

- procedures for reporting a lost or stolen access device and for reporting a crime;

- reaction to suspicious circumstances, such as a recommendation that a customer who observes suspicious persons or circumstances, while approaching or using an unmanned teller machine, should not use the unmanned teller machine at that time or, if the customer is in the middle of a transaction, should cancel the transaction, take the access device, leave the area, and come back at another time, or use an unmanned teller machine at another location;

- safekeeping and secure disposition of unmanned teller machine receipts;

- the inadvisability of surrendering information about the customer's access device over the telephone or over the Internet, unless to a trusted merchant in a call or transaction initiated by the customer;

- protection against unmanned teller machine fraud, such as a recommendation that the customer promptly review the customer's monthly statement and compare unmanned teller machine receipts against the statement;

- protection against Internet fraud, such as a recommendation that the customer, if purchasing online with the access device, should end transactions by logging out of websites instead of just closing the web browser; and

- other recommendations that the issuer reasonably believes are appropriate to facilitate the security of its unmanned teller machine customers.

Text Alerts

NOTIFY ME ALERTS!

If you would like a printable copy of these instructions please click here (Adobe PDF format).

Standard Terms and Conditions for enrolling in Notify Me Alerts:

- You must be an internet banking customer.

- Not all cellular carriers will support Notify Me Alerts via text messaging.

- You are advised that a cellular carrier may charge message and data rates for text messaging service. YOU MUST be the account holder for the mobile number given.

- A short code is provided, to which you can text “HELP” for assistance via text message, or “STOP” to stop receiving ANY Internet banking text messages.

- NOTE: If you only want to cancel Notify Me Alerts text messages, we recommend that you edit the Notify Me Alerts settings online rather than sending a “STOP” command via your mobile phone.

How Do I Opt In to Alerts?

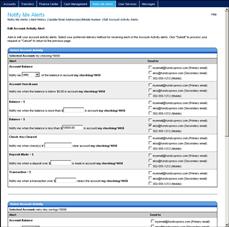

To opt in to receive Account Activity alerts on the Notify Me Alerts Page:

- Log in to internet banking, and then click the Notify Me Alerts tab.

- The Notify Me Alerts page appears.

- On the Notify Me Alerts page, click Update Email Address(es)/Mobile Number if delivery modes have not yet been set up.

- The Update Email Address(es)/Mobile Number page appears.

- Add or update the email address(es) and/or mobile number on this page, then click Submit.

For text message alerts:

- NOTE: The enrollment process requires you to enter a registration code that is texted to your mobile number, so you should have the mobile device at hand before starting to enroll.

- You should receive a text message from FundsXpress Financial Network on the mobile device, containing a registration code.

- The Enroll your mobile phone number for text alerts page appears.

- In the text box enter the registration code that was received. If you did not receive a registration code, use the Click here link provided on this page to request that another code be sent.

- Click the I have read and agree to Terms and Conditions checkbox.

- Click Submit to complete enrollment.

- The Text Alert Enrollment Confirmation page appears.

If you entered an email address:

- You will receive an email verification to new and old delivery modes that contact information has changed.

- Return to the Notify Me Alerts page, and use the Click here link to view more information about external email notifications.

- The Important Information page appears.

- Click Close Window to return to the Notify Me Alerts page.

How Do I Set Up Account Activity Alerts?

- To set up account activity alerts, click Edit Account Activity Alerts. (The Not Set or edit links can also be used.)

- The Accounts selection page appears, showing all accounts.

- Use the checkboxes to select the accounts on which to edit alerts, then click Edit Alert on Selected Accounts.

- The Edit Account Activity Alert page appears, showing all settings for each account activity alert for the accounts you selected.

- This page provides a separate Select Account Activity section for each of your accounts. In each section, all possible Account Activity alerts are listed, and for each alert, the available delivery modes. If some alerts have already been set up, they show the delivery modes selected in the Send to column, as well as any other settings (such as an amount) that have been specified for them.

- For each account, click the checkboxes in the Send to column to select delivery modes for the alerts you want to receive, or remove delivery modes for the ones you do not want.

- For each alert that has at least one delivery mode selected, you will set the alert’s parameter.

- Sends a notification at regular intervals containing the amount of the current account balance.

- Select a frequency for the alert: daily, weekly, biweekly, or monthly. For a weekly, biweekly, or monthly frequency, an additional drop-down list appears, allowing selection of the preferred day.

- Sends a notification when the account has been overdrawn.

- Sends a notification when the account’s balance is above the specified amount.

- Enter a balance amount.

- Sends a notification when the account’s balance is below the specified amount.

- Enter a balance amount.

- Sends a notification when the specified checks clear on the selected account.

- Enter one or more check numbers.

- Sends a notification when a deposit over a specified amount is made on the account.

- Enter a deposit amount.

- Sends a notification when any transaction over the specified amount is made on the account.

- Enter a transaction amount.

- Click Submit to save changes.

- A confirmation screen appears briefly, and then the Notify Me Alerts page appears with the Account Activity Alerts list showing the number of accounts that have alerts set.

| Alert | Description |

|---|---|

| Account Balance | |

| Account Overdrawn | |

| Balance > $ | |

| Balance < $ | |

| Check #(s) Cleared | |

| Deposit Made > $ | |

| Transaction > $ |

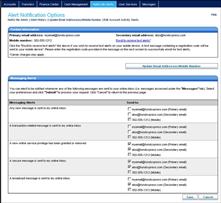

Setting Up Messaging and Security Alerts

Setting up Messaging alerts and Security alerts is almost the same as Account Activity alerts, except that there is no need to select accounts.

- Select the appropriate sub-tab on the Notify Me Alerts page.

- The Messaging Alerts sub-tab looks like this:

- The Security Alerts sub-tab looks like this:

- (The alert “A security-related change is made” always appears. You see other alerts only when you have corresponding Internet banking services and/or user privileges.)

- Click the Edit button for either sub-tab to go to the editing page for the selected alert type. The Messaging Alerts page looks like this:

- On the editing page, select delivery mode(s) to indicate where the desired alerts should be sent.

- NOTE: Most Security alerts are not optional. They have the primary email address selected as a delivery mode by default, and it cannot be removed.

- In the case of Security alerts, as illustrated below, some alerts take a parameter value. You can change the system default value if necessary, but cannot increase threshold values beyond limits that you specify.

- Click Save.

CardValet

CardValet Protect your debit and credit cards through your mobile device by receiving alerts and defining when, where and how your payment cards are used.

Benefits of CardValet

Fraud Protection

- Real-time alerts keep you informed when your cards are used

- Transaction controls allow your cards to work only in specific locations or geographic areas

- When your cards are "off," no withdrawals or purchases will be approved

Control Spending

- Set spending limits for general use or specify thresholds by merchant types, such as gas, groceries or retail stores

- Establish controls by location and change parameters via your mobile device

Business Use

- Use transaction controls for merchant codes, locations, transaction types and thresholds to ensure employee spending adheres to company policies

Review Balances and Transactions

- Monitor your finances anytime, anywhere by using the CardValet app to check your account balances or review recent card transactions